Credit One: Read the Details

Buon giorno. You know I try to sound the alarm now and then. After all, I hate seeing people get ripped off, get viruses, scammed or whatever. This monstrosity came in the mail, and I'm going to show the world how cafones like this gang conduct business. Many people want to begin, improve or rebuild their credit rating, often after declaring bankruptcy. Sneaky people play on the hopes and sometimes desperation of people.

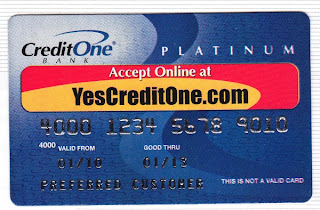

This one is not the worst, it's just typical. In the picture (click for larger), you'll see that this company is "CreditOne". Their logo looks deceptively similar to CapitalOne, that's the first thing that bothered me. And you're "pre-approved" unless they decide you're no good after all. Well, even legitimate companies pull this trick, so I can't complain too loudly. By the way, I think the pretend credit card that companies attach is kind of insulting; we know what a credit card looks like, Leroy. There's an expiration date, but so what? It will overlap with the offer that they'll send in another week or two.

This next picture is where I want people to pay close attention. The Annual Percentage Rate is not all that impressive, but keep reading. There is no grace period for purchases. Most legitimate companies will not charge you as soon as the purchase hits their computers, but these exploiters jump right on that. So throw out the concept of the ideal credit card use, where you use it during the month, get the bill, pay it all off and do not pay any interest. Not these guys.

And what's that? An annual fee! Not a chance, Chauncy. Cowboy Bob doesn't pay for the privilege of owning a card and paying your other fees. No siree. Oh, and there's a fee for an additional card for another user, but that's hit-and-miss with legitimate credit card companies.

This one is not the worst, it's just typical. In the picture (click for larger), you'll see that this company is "CreditOne". Their logo looks deceptively similar to CapitalOne, that's the first thing that bothered me. And you're "pre-approved" unless they decide you're no good after all. Well, even legitimate companies pull this trick, so I can't complain too loudly. By the way, I think the pretend credit card that companies attach is kind of insulting; we know what a credit card looks like, Leroy. There's an expiration date, but so what? It will overlap with the offer that they'll send in another week or two.

This next picture is where I want people to pay close attention. The Annual Percentage Rate is not all that impressive, but keep reading. There is no grace period for purchases. Most legitimate companies will not charge you as soon as the purchase hits their computers, but these exploiters jump right on that. So throw out the concept of the ideal credit card use, where you use it during the month, get the bill, pay it all off and do not pay any interest. Not these guys.

And what's that? An annual fee! Not a chance, Chauncy. Cowboy Bob doesn't pay for the privilege of owning a card and paying your other fees. No siree. Oh, and there's a fee for an additional card for another user, but that's hit-and-miss with legitimate credit card companies.

As I said earlier, this is not the worst I've seen. Wish I had one to show you, but that company learned not to send me their crapola. They were astonishingly deceptive as well as insulting. Guess they want people to be in a hurry to sign up. That one said, "No annual fee!" That was true. Instead, these jerks hit you with a monthly fee! If I recall correctly, that other one not only had the monthly fee, but a setup fee and several other outlandish fees tacked on.

If I do happen to find another of those outrageous credit card applications, I'll show you. But I'm not expecting one, especially since I have platinum cards with legitimate companies.

Even so, let this one be a lesson. Don't be in a hurry, or it can cost you, capice? Take the time to read the information on the terms, look for fees, whatever. Especially if it's from a company that you've never heard of and is trying to trick you into thinking they're a different company altogether. But as far as I can tell, this one and others are not doing anything outright illegal. Be careful, OK?

Comments

What sneaks!

Thanks 4 the warning.

Prov 22:7 The rich ruleth over the poor, and the borrower is servant to the lender.